Finance questions

You are evaluating a product for your company. You estimate the sales price of product to be $160 per unit and sales volume to be 10,600 units in year 1; 25,600 units in year 2; and 5,600 units in year 3. The project has a 3 year life. Variable costs amount to $85 per unit and fixed costs are $206,000 per year. The project requires an initial investment of $342,000 in assets which will be depreciated straight-line to zero over the 3 year project life. The actual market value of these assets at the end of year 3 is expected to be $46,000. NWC requirements at the beginning of each year will be approximately 16% of the projected sales during the coming year. The tax rate is 30% and the required return on the project is 11%. What will the year 2 cash flows for this project be?

You have been asked by the president of

your company to evaluate the proposed acquisition of a new special-purpose

truck for $430,000. The truck falls into the MACRS 7-year class, and it will be

sold after 7 years for $68,000. Use of the truck will require an increase in

NWC (spare parts inventory) of $6,800. The truck will have no effect on

revenues, but it is expected to save the firm $122,000 per year in before-tax

operating costs, mainly labor. The firm's marginal tax rate is 40 percent. What

will the cash flows for this project be during year 3?

You

are evaluating a project for your company. You estimate the sales price to be

$10 per unit and sales volume to be 3,000 units in year 1; 10,000 units in year

2; and 1,000 units in year 3. The project has a three-year life. Variable costs

amount to $3 per unit and fixed costs are $25,000 per year. The project

requires an initial investment of $50,000 in assets that will be depreciated

straight-line to zero over the three-year project life. The actual market value

of these assets at the end of year 3 is expected to be $10,000. NWC

requirements at the beginning of each year will be approximately 25 percent of

the projected sales during the coming year. The tax rate is 34 percent and the

required return on the project is 15 percent. What change in NWC occurs at the

end of year 1?

Suppose your firm is considering two

mutually exclusive, required projects with the cash flows shown below. The

required rate of return on projects of both of their risk class is 9 percent,

and that the maximum allowable payback and discounted payback statistic for the

projects are 2 and 3 years, respectively.

|

Time: |

0 |

1 |

2 |

3 |

|

Project A Cash Flow |

-36,000 |

26,000 |

46,000 |

17,000 |

|

Project B Cash Flow |

-46,000 |

26,000 |

36,000 |

66,000 |

Use the NPV decision rule to

evaluate these projects; which one(s) should it be accepted or rejected?

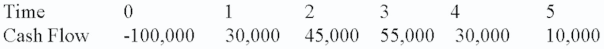

Suppose

your firm is considering investing in a project with the cash flows shown as

follows, that the required rate of return on projects of this risk class is 8

percent, and that the maximum allowable payback and discounted payback

statistic for the project are three and three and a half years, respectively.

Use the payback decision rule to

evaluate this project; should it be accepted or rejected?

Compute the Discounted Payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 13 percent and the maximum allowable discounted payback is 3 years.

|

Time: |

0 |

1 |

2 |

3 |

4 |

5 |

|

Cash flow: |

-970 |

420 |

560 |

480 |

380 |

230 |

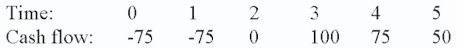

Compute the IRR

statistic for Project X and note whether the firm should accept or reject the

project with the cash flows shown as follows if the appropriate cost of capital

is 10 percent.

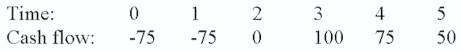

Compute the NPV for

Project X and accept or reject the project with the cash flows shown as follows

if the appropriate cost of capital is 10 percent.

Crab Cakes Ltd. has 5 million shares of stock outstanding selling at $15 per share and an issue of $10 million in 10 percent, annual coupon bonds with a maturity of 25 years, selling at 97 percent of par ($1,000). If Crab Cakes' weighted average tax rate is 30 percent, its next dividend is expected to be $1.00 per share, and all future dividends are expected to grow at 5 percent per year, indefinitely, what is its WACC?

-

Rating:

/5

Solution: Finance questions