The capital asset pricing model or the CAPM refers to investment risk and the return on investment that an investor should expect. The CAPM model plays a vital role in finance for generating returns for assets given the risk and cost of capital. In this guide, you’ll learn the various aspects of the capital asset pricing model with everything about it.

Also read:-

History of CAPM Model

The CAPM model refers to the capital asset pricing model built by William F. Sharpe, Jack Treynor, Jan Mossin, etc., based on the ideas on Modern Portfolio Theory and diversification in the 1960s. According to this model, an investor relies on the investing model, takes an amount of market risk, and maximize the returns on a portfolio. In 1972, another model named Black CAPM or zero-beta CAPM came into existence and helped in choosing stocks on the capital market line.

How Does the CAPM Model Works?

The CAPM model portrays the idealization of the financial markets price securities and determines the expected results on capital investments. It involves a methodology for quantifying and translating that risk and expect a good return on equity. The prime advantage of the CAPM model is the estimation of costs of equity yield by the model. It is a crucial addition to the financial manager’s tool kit. It is ideal for calculating the cost of equity capital. CAPM ensures risk-free rates over the discounting period. In the CAPM model, financial marketers measure risk and transform it into the expected return.

There are two assumptions for a Modern Financial Theory:-

- Security markets are competitive and efficient.

- There are a lot of rational, risk-averse investors who need maximizing satisfaction.

Category of Capital Asset Pricing Model

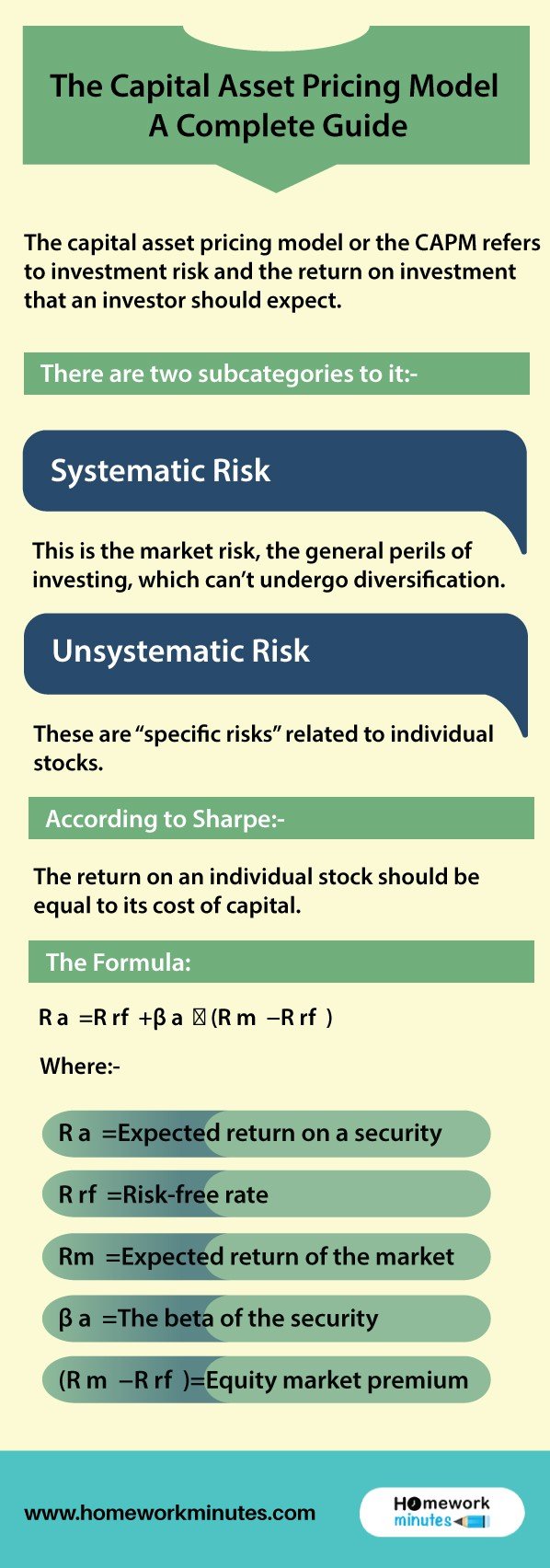

There are two subcategories to the CAPM model.

Systematic Risk

This is the market risk, the general perils of investing, which can’t undergo diversification.

Unsystematic Risk

These are “specific risks” related to individual stocks.

According to Sharpe:-

The return on an individual stock should be equal to its cost of capital.

The Formula:

R a =R rf +β a ∗ (R m −R rf )

Where:-

R a =Expected return on a security

R rf =Risk-free rate

Rm =Expected return of the market

β a =The beta of the security

(R m −R rf )=Equity market premium

Benefits and Limitations of CAPM

Keeping in mind all the above-said information of CAPM, here are some of its benefits and limitations.

Benefits

- CAPM is a simple model, which is easy to use and understand

- There are only systematic risks in this model

Limitation

- According to the investors, this model doesn’t cover all the risks in investing

- Does not evaluate reasonable returns

- Fail to reflect the future returns

If you need a tutorial on more such accounting and finance topics, seek instant online assignment help from our experts at Homework Minutes. We provide 24*7 help in various subjects. Chat with us now.