As we know that loans are the basic necessity of settling any money matters, there are many ways to take a loan. TIn this description; you get to know about the basics of lines of credit.

While studying about loans in your business studies class, you must have come across many ways to take a loan from the external sources. That is, one can approach a bank, make use of credit cards, turn to know ones, or follow other known modes as well. But, the learned business intellects understand the importance of lesser-known loan methods, used by lesser but is highly economical. The best lesser-known way in this line up is the lines of credit. To help you know it better, here is the brief account of the lines of credit.

For more topics on business studies, also read:-

Business Models Types | The Platform Guide

Benefits of Corporate Social Responsibilities in Businesses

What are the Lines of Credit?

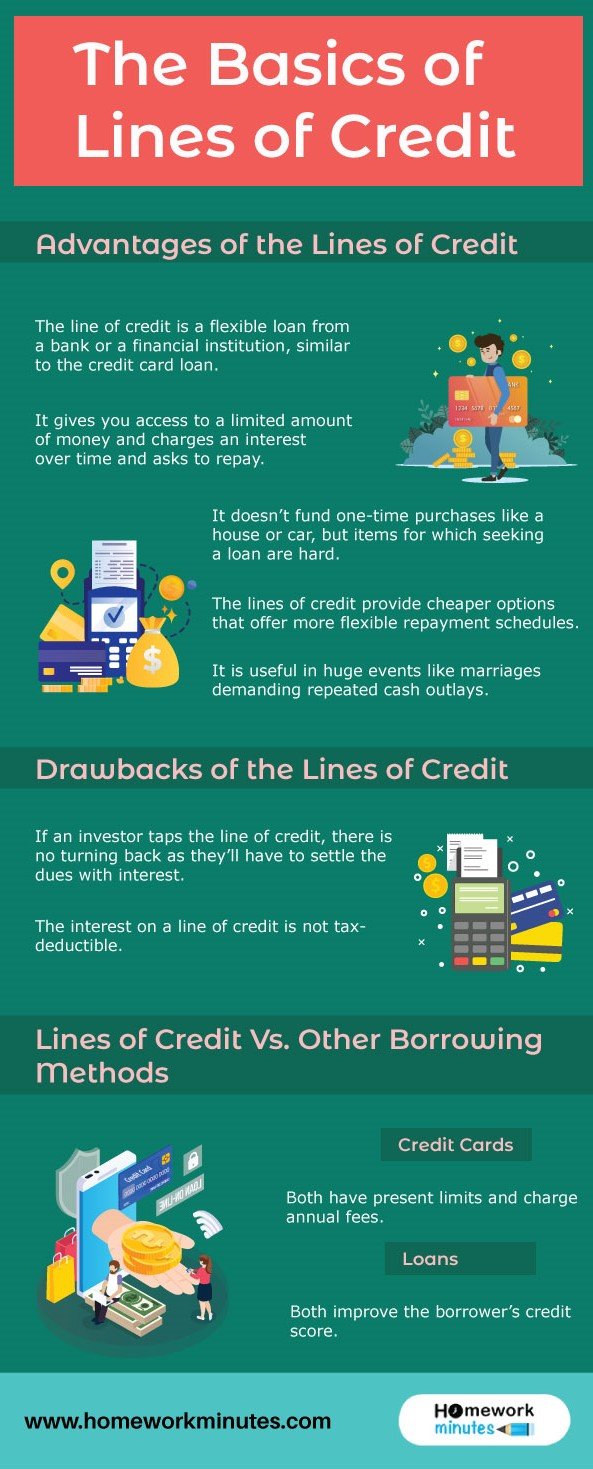

Since banks barely advertise about the lines of credit, many borrowers are unaware of this mode. The line of credit is a flexible loan from a bank or a financial institution, similar to the credit card loan. While taking up the lines of credit, the banks let you borrow money for a limited amount of time and asks to repay it specified period. As per the policies, the bank tends to charge interest on the amount of money borrowed.

Advantages of the Lines of Credit

- It gives you access to a limited amount of money and charges an interest over time and asks to repay.

- It doesn’t fund one-time purchases like a house or car, but items for which seeking a loan are hard.

- The lines of credit provide cheaper options that offer more flexible repayment schedules.

- It is useful in huge events like marriages demanding repeated cash outlays.

Drawbacks of the Lines of Credit

- If an investor taps the line of credit, there is no turning back as they’ll have to settle the dues with interest.

- The interest on a line of credit is not tax-deductible.

- Most banks make it mandatory to use the line of credit and even charge a maintenance fee if not used.

Lines of Credit Vs. Other Borrowing Methods

Compared to Credit Cards

Both lines of credit and credit cards have preset limits and charge annual fees. Both modes approve a fixed amount of money that the borrower can borrow. As for the difference, the borrower can secure their lines of credit with their property, which isn’t an option in credit card. In credit cards, the banks can charge monthly minimum payments and increase the rate of interest over time while this isn’t the case with the line of credits.

Compared to Loans

While taking a loan, a line of credit asks for a certain range of credit, repayment of funds, and charge interest. Both methods improve the borrower’s credit score.

If you need to understand more such business topics, you can get instant business assignment help from the top experts. Our service is available 24*7 at your discourse. Submit your queries and get the solutions before the deadline. Score an A+ grade in your business assignment with our expert guidance.