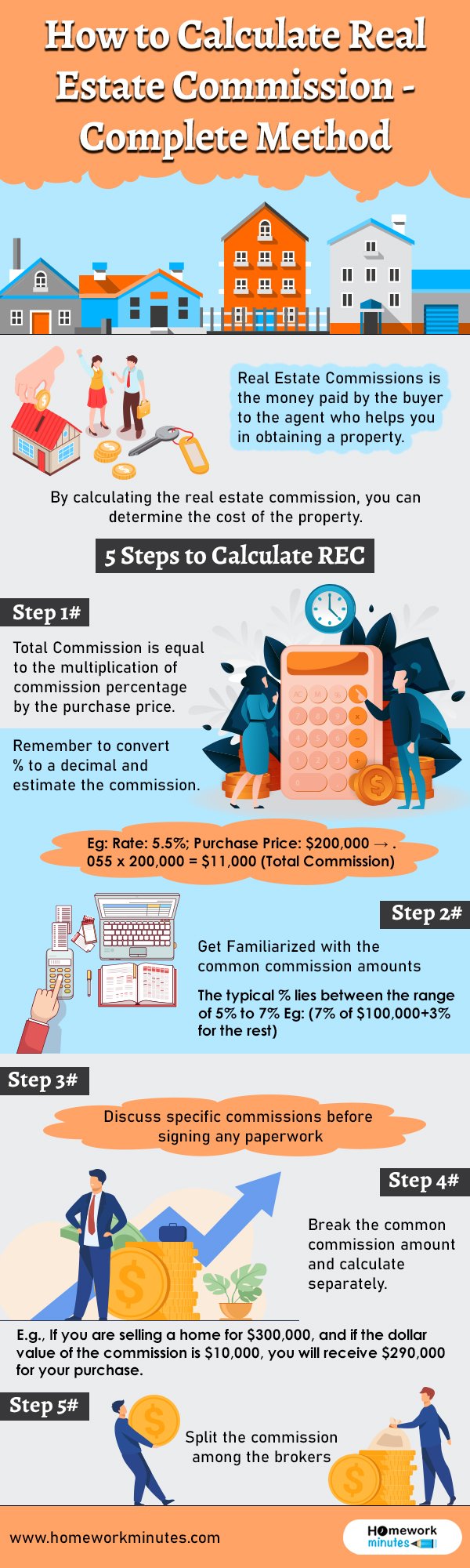

Where does the need to learn how to calculate the real estate commission arises? By calculating the real estate commission, you can determine the cost of the property. So, if you’re pursuing education in the field of real estate, this guide can help you understand the term, ‘real estate commission.’

Also read:-

What is the Real Estate Commission?

Real Estate Commissions is the buyer’s money to the agent who helps you in obtaining a property. Between the buying and selling process, there is a real estate agent who helps you make a deal with the broker. During the process, the home seller pays the commission, and then the overall commission further splits up by the agent who worked as a connective between the seller and the buyer. Moreso, this commission gets split up between the listing and the selling broker as well.

How Do Real Estate Commissions Work?

Before knowing how to calculate real estate commission, you must first understand how does the process work. As per the Real Trends Data from 2005, the report shows that the average commission rate in the U.S. is 5.02%. The real estate commissions are negotiable; in these terms, the agent and the buyer or the seller must set a fair deal before the sealing of the deal.

In the process, the seller ought to sign a listing contract, which marks the commission amount that has to be paid to the listing agent. Now the agents of the two counterparts can be the same or different. The real estate commission fee never goes straight to the real estate agents but to an intermittent broker. The fee shall then be consumed in determining the cost of things such as advertising, signage rental, and office space.

5 Steps to Calculate REC

Step 1# Total Commission is equal to the multiplication of commission percentage by the purchase price.

- Remember to convert % to a decimal and estimate the commission.

Eg: Rate: 5.5%; Purchase Price: $200,000 → .055 x 200,000 = $11,000 (Total Commission)

Step 2# Get Familiarized with the common commission amounts

- The typical % lies between the range of 5% to 7%

Eg: (7% of $100,000+3% for the rest)

Step 3# Discuss specific commissions before signing any paperwork

Step 4# Break the common commission amount and calculate separately

E.g., If you are selling a home for $300,000, and if the dollar value of the commission is $10,000, you will receive $290,000 for your purchase.

STEP 5# Split the commission among the brokers

Related Questions

Person Transforming Their Life From a Bad Habit

Devry chem120 2019 September Week 7 Discussion Latest

Binge Drinking on College Campuses

Writing Assignment : Family Likes and Dislikes

Elec 242 – Determine the Bilateral Laplace Transform

Lowering the Third Scale Degree of a Major Scale Changes Its